So you’ve had a great time working your way across the globe, but now it comes to the boring part.

Yes, no matter where you work and how exciting it can be setting up a temporary life on the other side of the world, there’s one thing you can’t avoid, and that’s tax!

Here at Big World Small Pockets, we’re huge fans of work and travel adventures, which not only allow you to prolong your global wanderings, but can also bring you huge personal rewards too.

Right now, in fact, we’re actually on our own working holiday adventure around Australia and are currently living it up in the paradise of Magnetic Island whilst managing a guest house. Yes, it’s a tough gig, but someone’s got to do it!

Anyway, I digress, the point is that on any working holiday you’re going to have to try and navigate the tax system in your new country of employment.

This can be a challenge, but as governments generally want you to pay tax, they often make contributing it easy.

What they don’t always make straightforward however, is getting your working holiday tax back.

Yes, this can mean getting a refund on any money owed to you by the government can be a real headache.

As good budget travellers however, we certainly know every penny/cent counts!

That’s why getting back any overpaid tax is always high on our list – it’s money you’re entitled to and it’s money you can put in the kitty for the next adventure!

From Australia to New Zealand, Canada to the UK, the rules for getting your working holiday tax back are always slightly different.

Nevertheless, I’ve compiled some top tips to help you out, so that wherever in the world you’re undertaking your working holiday, you can get your tax back without a whole ton of stress …

Related Posts

- The Best Insurance Advice for Long Term Travellers

- 10 Crucial Things to Pack for Australia that Won’t Fit in Your Suitcase!

- 7 Unusual Places to Visit in Australia With Your Campervan

This page contains affiliate links meaning Big World Small Pockets may receive a small commission on any purchases at no extra cost to you.

#1 Know the Tax Year

A good starting point when it comes to getting your working holiday tax back is knowing the basic rules in your country of employment.

This can be as simple as finding out when the tax year begins and ends.

By this I mean, the date from which the government starts calculating your annual earnings – the amount that will dictate how much tax you need to pay.

In almost every popular working holiday country, tax years start and finish at different times; don’t presume that wherever you’re working now will have the same dates as your home country!

Take a moment to familiarise yourself with this basic detail about the country you’re working in by calling a tax agent, looking on a government website or asking your employer.

Here are some common working holiday countries to get you started:

Tax Year Examples:

The UK tax year runs from 6th April – 5th April

The Australian tax year runs from 1st July – 30th June

The New Zealand tax year runs from 1st April – 31st March

The Canadian tax year runs 1st January – 31st December

The Japanese tax year runs 1st January – 31st December

Knowing the tax year dates of your country of employment is important because it is normally only after the tax year ends that you are able to file your tax return i.e. get your working holiday tax back.

Knowing the dates of the tax year in your working holiday country can also help you calculate how much you’ve earned in that year, and therefore how much tax you should have paid and how much you’re roughly owed.

Just enter your details below and I'll email it you - simple!

Information will be sent to the email provided above

Be Sure of your Status

Knowing your tax status in the country where you’re undertaking your working holiday is going to save you a whole lot of hassle, and potentially money, when it comes to getting your tax back.

As I’ve said before, different countries have different rules, but normally they’re fairly easy to discover.

Give the tax department in your county of employment a quick call to discuss your personal situation if it’s complicated or else a quick google should reveal the answer.

Again a fairly basic detail, but knowing your tax status in advance is a key step to lowering the headache-factor of getting your working holiday tax back.

Here’s some examples to quickly help you out:

Tax Residency Status Examples:

In Australia, you will most likely be considered a tax resident if you’ve been living and working in the country for a minimum of 6 months, generally without leaving for long periods of time.

This means most travellers on their year-long working holiday visa count as tax residents.

- To be sure however, the Australia Tax Office has a handy quiz to help you work it out: https://www.ato.gov.au/Individuals/International-tax-for-individuals/Work-out-your-tax-residency/

- In Canada, you will most likely be considered a tax resident if you have stayed in the country for 183 days or more within the tax year. The Canadian Tax Office also has a number of forms to assist you if you need further clarification: http://www.cra-arc.gc.ca/tx/nnrsdnts/cmmn/rsdncy-eng.html

- In the UK, you will most likely considered a tax resident if you have been physically present in the country for 183 days or more in a tax year. The UK also has a Statutory Residence Test that can be accessed here: https://www.gov.uk/government/publications/rdr3-statutory-residence-test-srt

Knowing your tax status in a country can help you work out the levels of income tax you should have been paying.

Putting this against what you have paid could be a good indicator of how much tax back you are likely to get.

Research Expenses

Expenses are usually items or services you have bought or paid for, which can be set against the amount of tax you’ve paid and be deducted from it.

Such items or services that might be covered by expenses include necessary work clothing or tools, any extraordinary transport or food costs or perhaps even rented premises or possessions.

Knowing the rules around tax-deductible expenses in the country where you have your working holiday visa is a great way to make sure you get the most tax possible back with the least confusion.

Expenses are also a budget traveller’s secret weapon because a little bit of knowledge in this area can go a long way on your tax refund bill!

Quite simply the more aware you are of what expenses you can claim, and to what extent, the great leverage you have when it comes to getting more tax back.

Some countries such as the UK only make allowances for tax-deductible expenses when you are self-employed, others like Australia have blanket rules across all types of employment.

Wherever you are, it is well-worth taking the time to find about the tax laws regarding expenses ahead of time so that you can make sure you know what you can and can’t claim when the tax year ends.

Knowing what is covered by tax-deductible expenses is a great step towards being organised and increasing your chances of getting your working holiday tax back without a headache.

Top Tip: Always keeping the receipts for things you think you might be able to claim as tax-deductible expenses and then file them away safely for the time when you do complete your tax return. Believe me, you’ll be so grateful you did!

Get an Online Banking App

This may sound like a strange one, but the reason I’ve included this is that having a catalogue of your bank account information easily accessible on your phone or tablet is a great asset when looking to get your working holiday tax back.

This is because, rather than having to keep paper bank statements and then having to trawl back through them when it’s tax refund time, banking apps simply and easily allow you to scroll back through a whole year’s worth of transactions in a few seconds.

This can be very helpful for working out the amount of interest you’ve been paid in a tax year – another key detail you’ll most likely need for your tax return.

Simply find the amount of interest you’ve been given each month by your bank in the last year and then add them all together.

Et voila!

Simple stuff!

Top Tip: If you can, link your bank account to your working holiday tax details so that any refund can be paid straight into your account. This is normally the quickest way to claim your refund and using an online banking app allows you to easily see when it’s been paid.

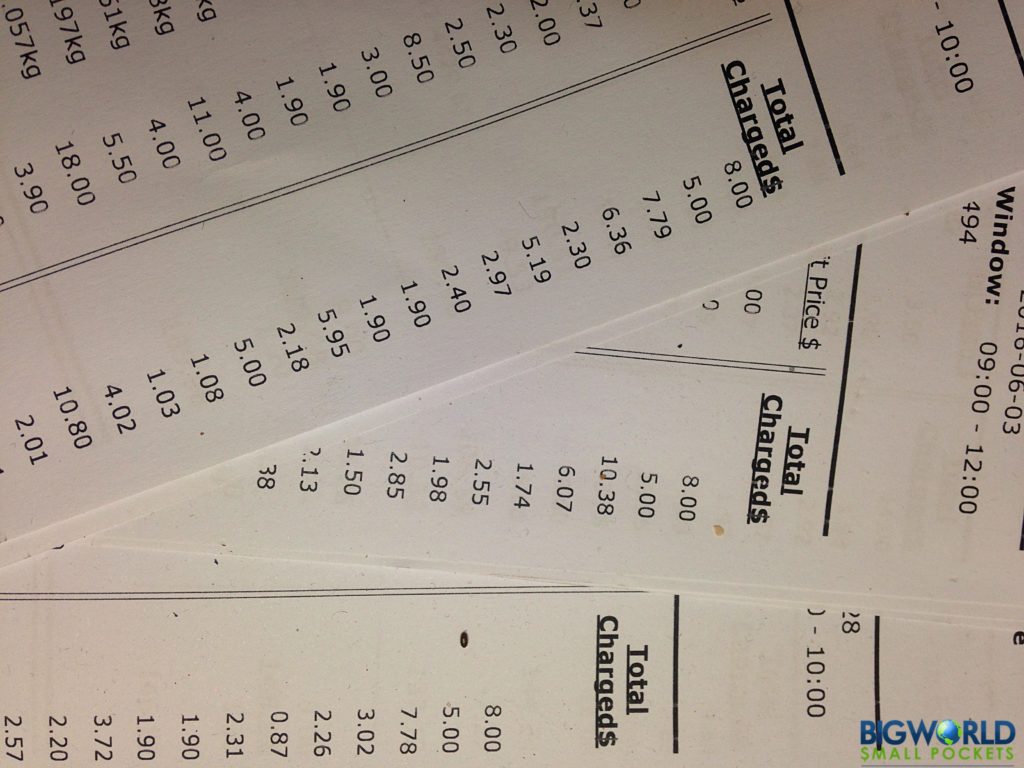

Keep Your Payslips

Having an easily accessible record of every penny / cent you’ve earned is a key step to claiming your working holiday tax back.

Without this information, it will potentially be a real struggle and a total mission to get anything back.

Having a log of what you’ve been paid, means you should also have a log of what tax you’ve paid and this will certainly make the tax back process slicker, quicker and a damn sight easier.

In essence, a record of all your payslips has almost all the information you need for a simple tax return, it’s just a case of filling in the details.

In many countries, you’ll also be sent an end of tax year report, which should tally with your most recent payslip.

Top Tip: Keep your payslips filed in order, with the most recent at the front or on top. This way, you can access your year to date earnings and tax deductions at a glance.

Use Taxback.com

Probably the simplest way however for you to get your working holiday tax back without a headache is to use a specialised agent. Taxback.com are one of the best examples around, guaranteeing you the maximum legal tax refund and ensuring you are compliant with tax laws.

Taxback.com have been getting tax back for working holiday visa holders, foreign students and expats since 1996 and now provide expert services in 13 countries across the globe including Australia, Canada, the US and Ireland.

Last year they got tax refunds for over 322,000 people and, with a plethora of awards under their belt, certainly are a highly reputable, trustworthy and professional bunch! Based online they offer clients a 24/7 service that aims to take the confusion out of your tax issues and make sure you get back what you’re owed.

PIN IT TO PINTEREST!

Super handy advice. I think now that E-Tax software is being fazed out using an agent may be the easiest way to do it now so you skip the hassle and can just enjoy the journey onwards 🙂

Couldn’t agree more Dan, thanks for your comments 🙂

Nice article and pictures!

We subscribe to your blog 🙂

Ultimate Paris Guide Team

Thanks guys