If you’re anything like me, then all the admin associated with travel can both really bore you and really stress you out!

However, after years of preparing for trips, I’ve gradually become more equipped to deal with this challenge, probably because I’ve also become more practiced and therefore more knowledgeable.

Never is this more apparent than when trying to choose a travel insurance policy, which I always do for any trip I go on.

I understand we all want to save money and budget our funds for travel, but buying insurance is really not an area of preparation you should forego. Believe me, it will cost you a heck of a lot more in the long run if something goes wrong!

I also understand, full well, that buying travel insurance can seem like a mind-boggling field of terms, conditions, clauses and confusion.

But fear not, after years of trawling through various options, it now makes a little more sense to me.

So, I’ve put together an easy guide to help you get the best policy too – here are 10 important things to look for when buying travel insurance.

Related Posts

- Best Insurance Advice for Long Term Travellers

- Ultimate Travel List for Going Away Preparations

- Best Carry On Packing Tips for Long Haul Flights in Economy

This page contains affiliate links meaning Big World Small Pockets may receive a small commission on any purchases at no extra cost to you.

#1 Who is the Insurer?

The first thing to look for when buying travel insurance is whether the company is certified by a registered body?

This is particularly important when buying travel insurance online, as there are all sorts of dodgy people out there!

You may also want to find out who is the underwriter of the policy.

This is the larger financial institution that basically agrees to pay out if your claim is accepted.

It’s a good idea if the underwriter is a bank or large insurance company you’ve heard of. If not, it’s worth googling them!

Just enter your details below and I'll email it you - simple!

Information will be sent to the email provided above

#2 What is the Excess?

Excess is the initial amount of money you pay towards a claim i.e. a fixed sum the insurance company deduct before paying you any money in the event of a claim.

Obviously it’s better to have a lower excess level, as this normally means you will get a bigger amount back in the event of a claim.

However usually, the lower the level of excess, the higher the cost of the initial travel policy.

This means you have to weigh up the costs of the amount of cover versus the amount of excess.

#3 Are Luggage, Passport and Money Covered?

Out of all the most likely things to occur when travelling, damage to belongings or loss of luggage, passport and money are the probably the most likely to occur.

It also means some insurers don’t cover them because they generate a high level of claims.

This means checking any policy your purchase covers these items is definitely one of the most important things to look for when buying travel insurance.

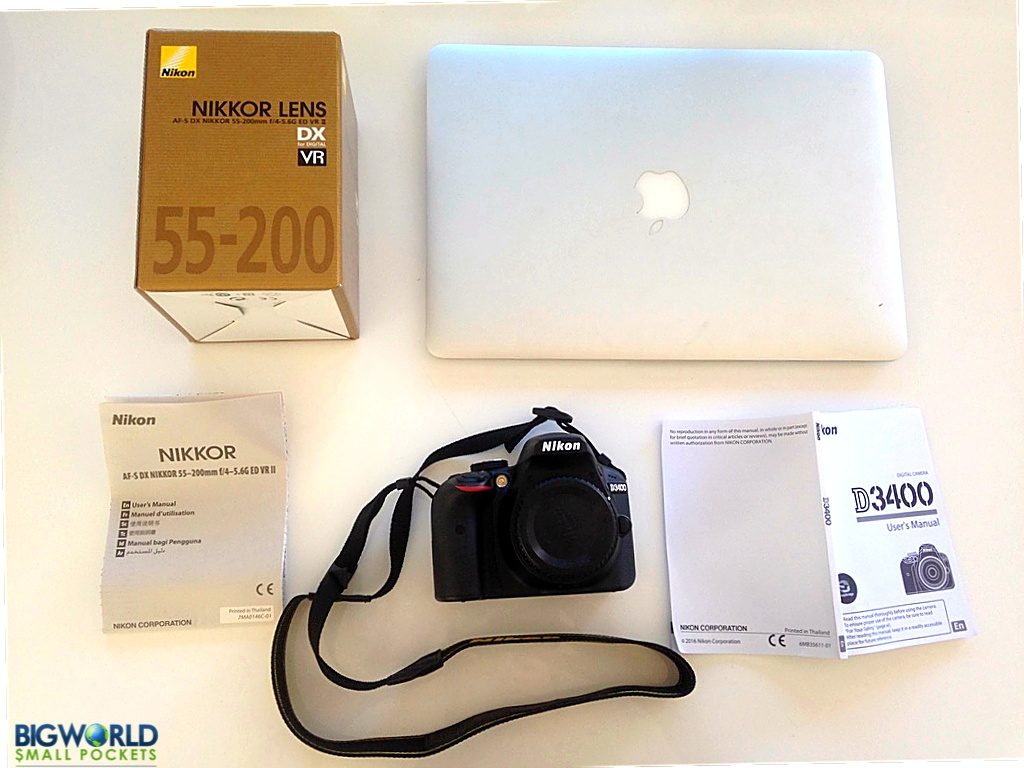

#4 What is the Single Valuables Limit?

Following on from the above point, it’s also a good idea to check the amount of money your luggage is covered for i.e. the maximum amount you can claim if anything happens.

Often, where valuable items are concerned, there will also be a single item limit as well.

This means there is maximum amount you can claim for each individual piece of your luggage, within the total amount of baggage cover.

This amount is normally listed under a valuables limit.

If you’re planning on travelling with any expensive items such as laptops or cameras, it really is a good idea to check the single valuables limit – if it’s only $200 and you’re laptop is worth $1500, you’ll miss out on a lot if it gets stolen.

#5 What Activities are Covered?

In terms of policy cover, one of the best things to look for when buying travel insurance is what activities you are insured for.

This is especially true if you plan on taking part in any extreme or higher risks sports like scuba diving, snorkelling, paragliding, skiing or rafting.

It’s also a good idea to check whether the insurance policy will cover you to work or volunteer – this might be essential if you’re using your Working Holiday Visa in Australia for example.

#6 Any Specifics You Want Covered?

This is a more personal question to consider, but I do think it’s important to buy a policy which suits your individual needs.

I, for example, always seem to have real problems with my teeth when I’m away, so make sure I buy a travel insurance policy that includes emergency dental cover.

You might wear glasses or contact lenses and therefore want to include something that covers a trip to the opticians, or pay for an add-on that will cover an expensive camera if damaged.

Whatever your personal circumstances, make sure your policy fits them.

#7 Time Allowance for Submitting a Claim?

It’s a good idea to know the amount of time you have to submit a claim before it becomes invalid.

For some insurance, this might be within a certain time period after the event or before the policy expires.

For other travel insurance, it might be unlimited.

The longer you have to make a claim, the better – particularly as some paperwork can take a long time to organise when in a foreign country.

Finding out about a policy’s claim period is therefore definitely one of the top things to look for when buying travel insurance.

#8 Do you Need a Return Ticket to Claim?

With many travel insurance companies, you will require a return ticket to make a claim.

This is often only printed in the small print of any policy, so make sure you check if you only have a one-way flight booked.

Travel insurance from World Nomads is great in this respect, because they certainly let you claim without a return ticket – in fact, they are one of the few companies I’ve found that do.

I use them every time I go away – because I rarely have a return ticket – and can highly recommend them!

#9 Can you Claim Online?

I also like travel insurance from World Nomads, because of their great online facilities – this is particularly helpful if you’re overseas, becasue it means you don’t have to worry about navigating time zones or paying for expensive international phone calls.

With World Nomads, you can make a claim online, check your policy cover and wording 24/7 and get quick answers to any questions over email.

#10 Will you be Able to Extend your Policy?

If you’re anything like me, travel plans easily change!

That is why I always like to buy travel insurance that allows me to extend or alter my cover.

*** Check out my article about the best advice when buying long term travel insurance if this applies to you too! ***

Many companies will only cover you for up to 12 months, but again World Nomads can insure you for up to 18 months.

If you are currently insured with another company and worried that your policy will expire while you’re still away, then don’t!

With World Nomads you can even buy insurance while you are still away.

This is great news for us long termers, so why not look at getting a quote from them today!

PIN IT FOR LATER!

So that’s it guys, the 10 important things to look for when buying travel insurance.

Hope you found the article helpful and please let me know if you have any other great insurance tips 🙂

Thanks for this post, I have not yet set out on a really long term trip but plan on becoming a serial expat next year. It is really helpful to know what to look for, some tips were obvious but a few were not.

Great Karen, glad some of the tips you found helpful and hope you enjoy your trip next year!

am an Official Old Broad – 75. I want to do some European – possibly Australian – travel before I stiffen up completely (or permanently). Any advice for an older woman travelling alone?

I think my main advice Connie is just go for it! I’ve met tons of older women traveling solo in my time and generally they are all fantastic, fun people, who are so glad they bit the bullet and got out there. Certainly getting a good insurance policy for your adventures is a must, perhaps maybe a backpack on wheels is something else to think about. Don’t over pack however and don’t be afraid young people won’t want to converse with you … they definitely will!

Thank you for the encouragement! My sons are against it – probably because they are policemen and currently in the “Let’s parent our parents” mode. There are a number of things I want to see around London and that city is museum paradise.

Sure is Connie! Let your sons know that many older people live in London and is it safe for them!